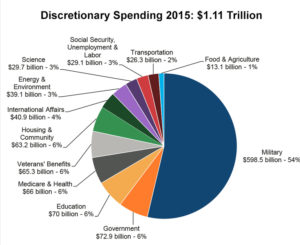

Over half of the US Government’s non-entitlement spending is military.

With President-elect Trump’s arrival in the Executive Branch, perhaps it’s time to step back and think about the role of government. If we agree on the role, we can better debate from the left and right how this role is best carried out.

Free markets have many advantages, but also offer some real pitfalls. The government’s role stems from the self-serving interest of market participants – companies and consumers alike. This greed is good: it leads to innovation, wealth creation, productivity, striving to improve, and many other positives propelling our economy and society forward. But what is best for the individual or family is not necessarily best for the nation, hence the role of government.

What are the big things that markets can’t carry out well on their own?

They cannot set laws or ensure their just enforcement. In fact, a comprehensive legal code and judicial system are at the heart of economic development. Attorney generals from 20 states just accused a handful of generic-drug manufacturers of price fixing. Price fixing is easy in our increasingly consolidated industries (aka oligopolies). Without the law and our judicial system, price fixing would be rampant as companies act to maximize shareholder value.

Markets can’t deliver enough public goods. If I purchase a movie ticket, I receive a benefit, not my neighbor, because movies are private purchases. But my community benefits if I educate my child; hence the term public goods. Individuals on their own would under-invest in public goods. Therefore we use tax incentives and direct investments to advance public goods. Education, basic research, national defense, infrastructure, public health, and parks, among other things, are public goods at the heart of a growing economy. Obama was criticized for saying no company succeeds on its own. He was referring to the fact that every company in our country benefits directly or indirectly from public goods and our legal system.

Markets cannot mitigate the actions of one company or even industry that has adverse impacts on others because prices do not reflect that adverse impact. Look at China’s air to understand costly externalities. Its coal plants pollute and life expectancy falls because China’s regulatory system and enforcement are so much weaker than our own.

Markets cannot protect those unable to succeed in the market system. Included in this category are the disabled, the poor, and the children born to parents unable to care well for them. We have government social services and a financial safety net for these reasons.

Finally, markets cannot fix themselves. For example, they cannot break apart natural monopolies, in which cost advantages or network advantages allow one company to dominate an industry and use its advantage for further gain. We create public monopolies (e.g., municipal water) or regulate privately held ones (Google and Microsoft) to make sure monopoly power does not foreclose others’ success. Watch out for a case against Amazon soon. Healthcare is a market that does not work well, according to even the most conservative of economists (Hayek) who argues the case for government-provided social insurance.

Federal Agencies all exist for one or more of the reasons listed above. Agriculture, Commerce, Defense, Education, Energy, Health and Human Services, Homeland Security, Housing and Urban Development, Interior, Justice, State, Transportation, Treasury, and Veterans Affairs are agencies with Cabinet positions. Government’s role also led to the creation of government-owned corporations and independent agencies, such as the Federal Election Commission, National Archives and Records Administration, the Consumer Product Safety Commission and The National Science Foundation.

My hope is we can agree on government’s role. So why do political disagreements arise? Here are some areas where sharing divergent political views could lead us towards more collaborative solutions (as in no one side has the whole answer).

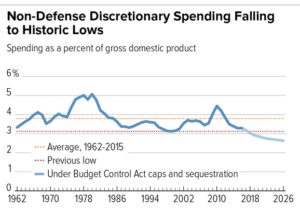

Non-military discretionary spending is small and declining as a percent of GDP.

Is government structured the right way? One example: If we brought together all services that shape/help poor people and those needing the safety net, might government become more efficient and effective? Communities are finding that locating social services in schools or neighborhoods (e.g., Harlem Children’s Zone), advances effectiveness for a given investment level.

Should decisions be made at the local, state or national level?

Do regulations go too far in imposing costs versus benefits? Or not far enough?

Can the private sector conduct the government’s business more cost effectively? Sometimes, yes, but private providers have perverse motivations. Insurers do not want to insure those with high medical bills. Privatized prisons created a lobby that pushed people unnecessarily into jails versus rehab or at-home monitoring and probation.

Are there more efficient ways to carry out regulations? To reduce greenhouse gasses, many economists recommend a carbon tax over regulations that close coal mines. That kind of pricing mechanism would incentivize companies most able to reduce our nation’s greenhouse gasses to do so; companies for which it would be very costly to reduce greenhouse gasses pay for the incentives. Acid Rain was solved using this mechanism.

Finally, how progressive should our tax system be to pay for government?

As we debate these issues, let’s not forget why we have a federal government. And let’s not forget that federal spending excluding military and entitlements like social security is only about 3% of GDP and falling. The real debate concerning the deficit should be around entitlement programs and military spending. Otherwise, we risk throwing the baby out with the bathwater.

Leave a Reply