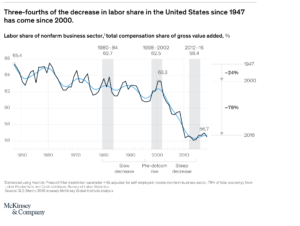

Labor’s share of national income has been falling. Some wage inflation could be a good thing!

Our two political parties each champion a set of recommended economic policies. For the GOP, tax cuts are always helpful. For the Democrats, not so much—but government spending can solve a lot of problems.

As an economist, the rigidity of political views – not just among the politicians but their distinct tribes of voters – dismays me. Why? Because different contexts demand different solutions.

In early 2009, Captain Sullenberger went against traditional thinking when he safely landed an Airbus A320 on the Hudson Bay after it hit a flock of birds, cutting off all engine power. He didn’t follow standard procedures because he and co-pilot, Jeffrey Skiles, recognized the uniqueness of the situation.

An economy is a far more complex system than a plane and its interaction with air. With any complex system, physics proves that starting conditions matter for what you do to alter the system.

If credit markets are tight, unemployment is falling, and interest rates rise, more government spending makes no sense. It will crowd out private sector investment, not a good thing for a market-driven allocation of resources. But when the economy is in the depths of private sector shrinkage, like the COVID-19 pandemic, government spending is the only thing to help.

So why the unending criticism from the GOP about the last stimulous bill and two new proposals on the table from Biden? There are three reasons.

The GOP fears inflation. Context matters here. We have not been in a period of high inflation rates. Instead, the Federal Reserve struggled for years during the Obama-Trump upturn to even reach a low target. We live in an economy with a temporary shortage of select supplies (thanks to the pandemic) but a long-term global surplus of capacity. The uncontroled inflation fears are unfounded.

Also, new spending driving unemployment to lower levels with some wage increases is not necessarily a bad thing. The share of labor in national income has been declining precipitously; it’s time for a reversal. (See Chart above.) Economists have shown that long periods of unemployment hurt individuals’ lifetime earnings. Revving the economic engine will be hugely beneficial to many.

Recently, the jobs report showed that hiring was just a fourth of what economists expected. It appears our economy still seems to have a long road to full recovery before permanent inflationary pressures kick in.

They fear the government being too involved in the economy. I am glad our government is neither manufacturing vaccines nor distributing food, for example. (That action, by the way, is the definition of socialism.) But there are some things – called public goods – that only government can provide. National defense is one, albeit here we use private sector companies to carry out the federal spending on manufactured defense goods. Unlike with defense spending, our nation has underinvested in our infrastructure for decades, as evidenced by the crumbling roads and bridges of our nation’s highway system. It’s time to reinvest.

$621B of the $2T plan is for transportation and $111B for water. The GOP likes these categories. But a 21st-century economy needs additional infrastructure than what the last two centuries required. Biden is proposing spending on digital infrastructure ($100B), repair and upgrade of schools ($100B), manufacturing technology ($300B), and vital R&D ($180B). These are expenditures that only the public can do. All are drivers of our future economic success.

The GOP also criticizes the spending on the workforce and aging at home ($400B) and housing ($213B) in the infrastructure bill. With ample workers, a healthy population, and affordable healthcare, this spending would be unneeded. But we have mismatched skills, an aging, generally unhealthy population, and housing costs that drive workers away from where they’re needed. Again, context matters.

The Biden plan has a payment mechanism built into it, so fears of using up fiscal capacity for a future need (e.g., war) are unwarranted. Closing corporate tax loopholes and raising the rate somewhat are doable with less adverse economic impact than the benefits infrastructure spending provides.

The GOP worries our social safety net is getting too rich. Here we look at Biden’s proposed $1.8T injection into our social safety net. Taxing the wealthy and beefing up the US IRS to collect about $700B in taxes left uncollected due to low audit rates will pay for the benefits. Called the American Families Plan, it invests in our children and families. It aims to boost female labor force participation, needed as we struggle to replace the aging baby boomers. It provides $200B in universal access to early childhood schooling. We know from past studies this spending has high payback. The bill also proposes lower healthcare costs for those unable to afford them and $225B for a national family and medical leave policy.

We have a growing and record-breaking inequality of wealth and income. It makes shifting money from the very rich (more than $400,000 a year income) to help young children and their family wise policy indeed. Another result is more births, which would be great for the future labor force. And economists have shown that highly unqual income forstalls economic growth.

I disagree with free community college as a lot will go to students who do not need it. Far better to focus the grants on those without income to pay tuition. Another approach is loan repayment linked to earnings.

As the debate proceeds, suspend your prior assumptions about government policy and think about the specifics of the current economy. Also remember that Biden designed the infrastructure bill to support cities in decline, not just those thriving. In a digital world, these places – offering affordable housing and higher quality of life – could thrive. The Biden boost will give them a chance. And both new bills are paid for, stemming inflationary fears.

Perhaps the unstated fear of the GOP is the popularity of the proposed spending with the American public. No wonder the bills are popular beyond Democrats. Given the context, they’re the kinds of changes our economy and our people need.