US President Joe Biden and his team are traveling the country spouting the success of his economic policies. The package is called “Bidenomics.” It’s best understood as a contrast (which I’ll get to shortly) to traditional GOP economic policy recommendations. The latter argues for lower taxes, less government regulation, and minimizing social welfare spending. The fear underlying GOP dismissal of Bidenomics is that we will become a “socialist” nation. Think of Scandinavian nations with high taxes and high social spending. (The fact that these nations do not engage in socialism – a system where the government owns the means of production, distribution, and exchange – is beside the point. But discussing that would be a digression here.)

The GOP policy prescription is based on core assumptions such as:

- The private sector can spend money more efficiently than the government. Low taxes on corporations and the wealthy free capital and spending, which trickles down to benefit the middle and lower classes.

- Regulation is a cost. With higher costs, there are fewer new businesses, lower profits (hence less income and reinvestment in business), and companies less competitive in global markets.

- A solid social safety net discourages work, causing the cost of labor to rise and our businesses to be less competitive in trade.

Bidenomics stems from a different set of assumptions.

- There are times when public spending can advance business success. US infrastructure is in terrible shape owing to years of under-investment, from roads to broadband in rural areas. The infrastructure bill passed last year includes billions a year to repair our infrastructure.

- Regulation and incentives can make the nation more resilient. Biden’s Chips Act encourages onshoring of critical technologies for the emerging digitally-based economy. It “provides roughly $280 billion in new funding to boost domestic research and manufacturing of semiconductors in the United States.” Environmental and financial market regulation, Bidenomics states, avoids harm to people and the economy.

- Our social safety nets are too weak, especially regarding children, our future labor force. The nation also needs help keeping older, ailing adults in their homes. Healthcare and childcare jobs can provide full employment to those lacking college degrees. Data shows that spending on children has positive long-term benefits for them. And women enter or stay in the workforce when care for parents and children is affordable.

Biden is trying to advance the economy by making high-end industries more competitive internationally, creating jobs linked to energy independence and improved infrastructure, and helping the non-wealthy with child rearing and aging. He supports minimum taxes on corporations and the wealthy (those with incomes over $400 million) to address our debt issues and fund this “middle-out” spending.

So, which political party’s consistent recommendations are correct?

The answer rests in understanding that the US economy is a system, working within a global economy which is also a system. Furthermore, the economy is a non-linear system. I don’t want to get all nerdy on my readers. Still, in essence, a non-linear system means the impact of a specific change (e.g., 5% lower taxes on those earning $400k+) will not always be the same. It depends on the starting situation. By contrast, a given government policy would always have the same impact in a linear system.

Let’s look at some examples of this nonlinearity.

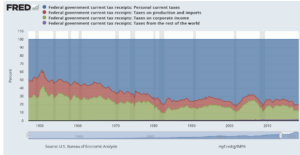

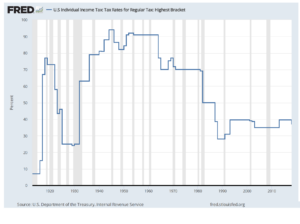

- Reducing taxes on the wealthy makes a lot of sense when too little financial capital is available to new and existing businesses. But our personal income tax rates are historically low and as is the corporate share of total tax revenue. And there is no evidence that Trump’s lowering these taxes (unlike JFK’s in the 1960s) increased investment. (See Charts)

- If there is too little consumption, as there was during the advent of Covid, giving government transfers to the lower and middle classes made far more sense than cutting taxes on the wealthy, who have a far lower propensity to spend than those with lower incomes.

Biden argues it’s time for a new paradigm as the post-2008 financial recession is a different economy with different needs. For example, we need more women in the workforce to grow GDP. Helping them with childcare and elderly care will achieve this goal. A green energy transition will create jobs and make us more resilient. And our supply chains, designed for efficiency, could be far more resilient, as we learned in the COVID years. Biden’s incentives for US-based manufacturing create resiliency.

Bidenomics is working. Inflation is falling and is lower than that of developed nations. We are becoming more energy independent. Frighteningly high and- growing income inequality has been cut by a quarter. Unemployment is at record lows. GDP is growing. And if Congress would get its act together, a solid immigration plan could end labor shortages and ensure that wage growth and inflation do not get out of hand.

As you listen to the candidates, remember that what is right “depends.”